Eligibility Requirements

Who is eligible for financial aid at HT?

You might be surprised to learn who qualifies for and receives financial aid. More than two-thirds of our undergraduates receive some sort of financial aid, including need-based grants, merit scholarships, Federal Work-Study and loans.

Students and families can rest assured that HT maintains a strong investment in financial aid for undergraduate students. We continue to increase financial aid funding to meet the needs of the Ram Family.

Eligibility Requirements

Basic Requirements for Need-Based Financial Aid

All applicants to HT can apply for financial aid if they:

- Are a U.S. citizen, eligible non-citizen such as a permanent resident

- Possess a valid Social Security number (if required); and

- Meet all published deadlines and submit any additional requested information in a timely manner. Applicants who miss published deadlines may be considered for reduced funds.

International Students

Although international students are not eligible to receive federal or HT need-based financial aid, they may be awarded merit scholarships and/or other departmental awards.

Additionally, international students may apply for some private loans with a qualified co-signer who is a U.S. citizen.

How Financial Aid Works

What Is Financial Need?

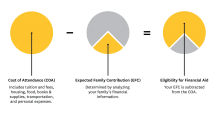

Your financial need is the difference between how much it costs to attend college (the Cost of Attendance or COA), and how much you and your family can contribute towards your education (the Expected Family Contribution or EFC). This is determined by analyzing your family’s financial information.

How Your Financial Aid Eligibility is Determined

HT analyzes your family’s financial resources to determine how much you can reasonably afford to pay out of pocket, and how much financial aid you might qualify for.

As part of this analysis, you may be required to submit the following information:

- Your parents’ taxable and untaxed income.

- Family assets (money in bank accounts, stock funds, real estate, etc.).

- Any special circumstances your family has (such as a job loss or higher-than-average medical expenses).

- The number of children in your family.

- How many children are full-time undergraduates in college.

- How close your parents are to retirement age.