Investing in HT

Alumni Reunion Weekend

6:00 p.m. – 9:00 p.m. Read More »

Annual Fund

The Annual Fund is the foundation of Huston-Tillotson University’s fundraising program. Its monies are unrestricted and used to meet the University’s most crucial needs annually. The Annual Fund supports the mission of the University by introducing alumni, parents, friends, faculty, and staff to the importance of giving yearly to enhance programs and assist in the daily operations of the University.

Establish a Scholarship

Institutional Advancement staff is available to work with you to define and establish scholarship funds. With your instructions, we will compose a letter that will provide the University with specific direction to administer the fund in accordance with your intentions.

Call the Director of Development and Alumni Engagement at 512.505.3115 for more information.

Class Reunion Gift Campaign

Your class reunion is a very special time – a time to return to campus, reunite with old friends, and perhaps reconnect with a favorite professor. It is a time to remember your earlier years and reflect on everything that you have gained from your time spent in the classrooms, on the playing fields, and in the residence halls of the University. It is a time to come back and, most importantly, an opportunity to give back!

Planned Giving

Planned gifts give back, allowing you to take sizable income, capital gains, and estate deductions on your taxes. They can provide income for you and your family for life. In addition, planned gifts can be much larger than other gifts, so you can leave a legacy that fits your philanthropic goals.

More Ways to Give

You can make education possible for every student through your transformational investment now.

The options below outline ways for you to support Huston-Tillotson University today and in the future. Begin now by reviewing your options. Afterward, visit with your financial advisor or attorney for the best option. Your gift continues to ensure WE ARE HT!

Bequests

Bequests are the most common and simplest way to give to Huston-Tillotson University. A bequest is a gift of any amount that is made through a donor’s will. Donors may include Huston-Tillotson University in their wills by simply naming the school for a specific dollar amount (legacy), specific asset, or percent share of their estate. Donors may also name HT as the residual beneficiary of their estates after the payment of bequests to others.

Donor-Advised Fund

A Donor-Advised Fund, or DAF, is a giving account established at a sponsoring organization or public charity. It allows donors to make a charitable contribution, receive an immediate tax deduction, and then recommend grants from the fund over time. Donors can contribute to the fund as frequently as they like, and then recommend grants to Huston-Tillotson University or other charitable organizations whenever it makes sense for them. Common sponsoring organizations include Schwab Charitable and Fidelity Charitable.

Gift Annuities

A gift annuity agreement provides contributors who donate cash, securities, real estate, or personal property with fixed annual payments for a specified period of time. Donors who choose a deferred gift annuity will begin making the annual payments at a time specified by them. Gift annuities are beneficial for donors who want to receive income from assets that have increased in value, such as cash or stocks. In exchange for gifts of such assets, donors are guaranteed a lifelong fixed annual income and avoid capital gains tax; in addition to an income tax break on a portion of the earnings from an annuity, the exact amount depends on their age.

Charitable Lead Trusts

Charitable lead trusts mostly appeal to wealthy donors who want to pass along appreciated assets to their heirs at a reduced gift or estate tax cost. These trusts allow Huston-Tillotson University to receive income from the donor’s assets for a specified time, after which the asset is returned to the donor/donor’s heirs, who do not have to pay any additional taxes.

Charitable Remainder Trusts

Two basic types of charitable remainder trusts – unitrust and annuity – allow you to qualify for federal tax benefits while receiving income from your stock, cash, or other assets. Once you give your assets to a trust, those assets are invested, producing income for you – or another beneficiary – for either a fixed time or your lifetime. You may claim a tax deduction for the estimated portion of the assets that will ultimately come to Huston-Tillotson University. At the end of the trust period, HT keeps all remaining assets.

Life Insurance

Give the gift that keeps on giving by naming Huston-Tillotson University the irrevocable owner and beneficiary of a life insurance policy. Below are several convenient ways to use a whole or universal policy as a charitable gift. Contributing a paid-in-full policy that you no longer need does not diminish your current income and may provide you with an income tax deduction for the replacement value of the policy. Your gift may also save you substantial estate taxes. You may also contribute a policy that is not paid in full and take a deduction for the “cash surrender value” of the policy. You would continue to make gifts – deductible charitable contributions – to HT to pay the premiums. You may fund a Charitable Remainder Unitrust for your spouse with life insurance. The premium payments would be partially tax-deductible, and the trust would provide income for your spouse after your death.

Personal Property or Real Estate

Huston-Tillotson University welcomes gifts of tangible property that further Huston-Tillotson’s educational endeavors, which the University would otherwise need to purchase. Gifts of real estate can generate significant tax benefits for donors and eliminate problems that come with the settlement of estates. The gift can be for a fractional interest in the property or the entire property. Donors often transfer their property to a trust that generates income for them for life, then on to Huston-Tillotson after their death.

Disclaimer

The Institutional Advancement Office at Huston-Tillotson, its employees, and representatives do not offer legal or financial advice. Prospective donors should consult with an attorney, financial advisor, estate planner, or accountant before making arrangements.

Convenient ways to make a gift:

Online

Supporting the University is simple. Donate to HT using the secure online method

By Mail

If you prefer to mail your gift, please make your check payable to Huston–Tillotson University and send it to the following address:

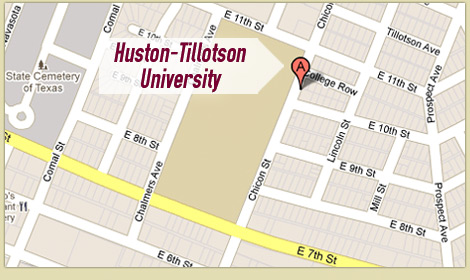

Huston-Tillotson University

Institutional Advancement – Annual Fund

900 Chicon Street

Austin, Texas 78702-2795

By Phone

To make a gift by telephone, please call 512.505.3113 Monday through Friday between 9:00 a.m. and 5:00 p.m. CST.

Salute the past, embrace the present, and make your mark on the future with Huston Tillotson University Brick Campaign!

Your personalized brick will be displayed at the Union Plaza and walkway, in the heart of the University. This ensures that thousands of students, alumni, and RAM fans will recognize your role in helping pave the way for the Future RAMS; plus, you will be leaving your legacy! Download an order form and purchase your brick TODAY!

Remember, this is a unique gift for your favorite RAM or yourself.

- Commemorate commencements, reunions ,and other milestones

- Etch your name into the history of your alma mater

- Memorialize a treasured individual, campus organization, fraternity,y or sorority

- Declare your devotion to a RAM team, club, or chapter

*All bricks are installed annually in time for viewing at Homecoming. Purchase by October 25, 2019 to be installed by Homecoming 2020. Please note that during some events your personalized paver/brick may be temporarily covered.